Hado - Siora Community at Dubai Islands

Investment Starts From

Starting from AED 2.4M

Project General Facts

Property Type

Apartment

Developer

Beyond (Powered by Omniyat)

Completion Date

Sale Status

Investment Features

About This Project

Comprehensive project overview and investment highlights

HADO BY BEYOND: THE NEW NORTH AND THE STRUCTURAL SHIFT IN DUBAI REAL ESTATE

An Exclusive Investment Analysis by Ali Faizan Syed

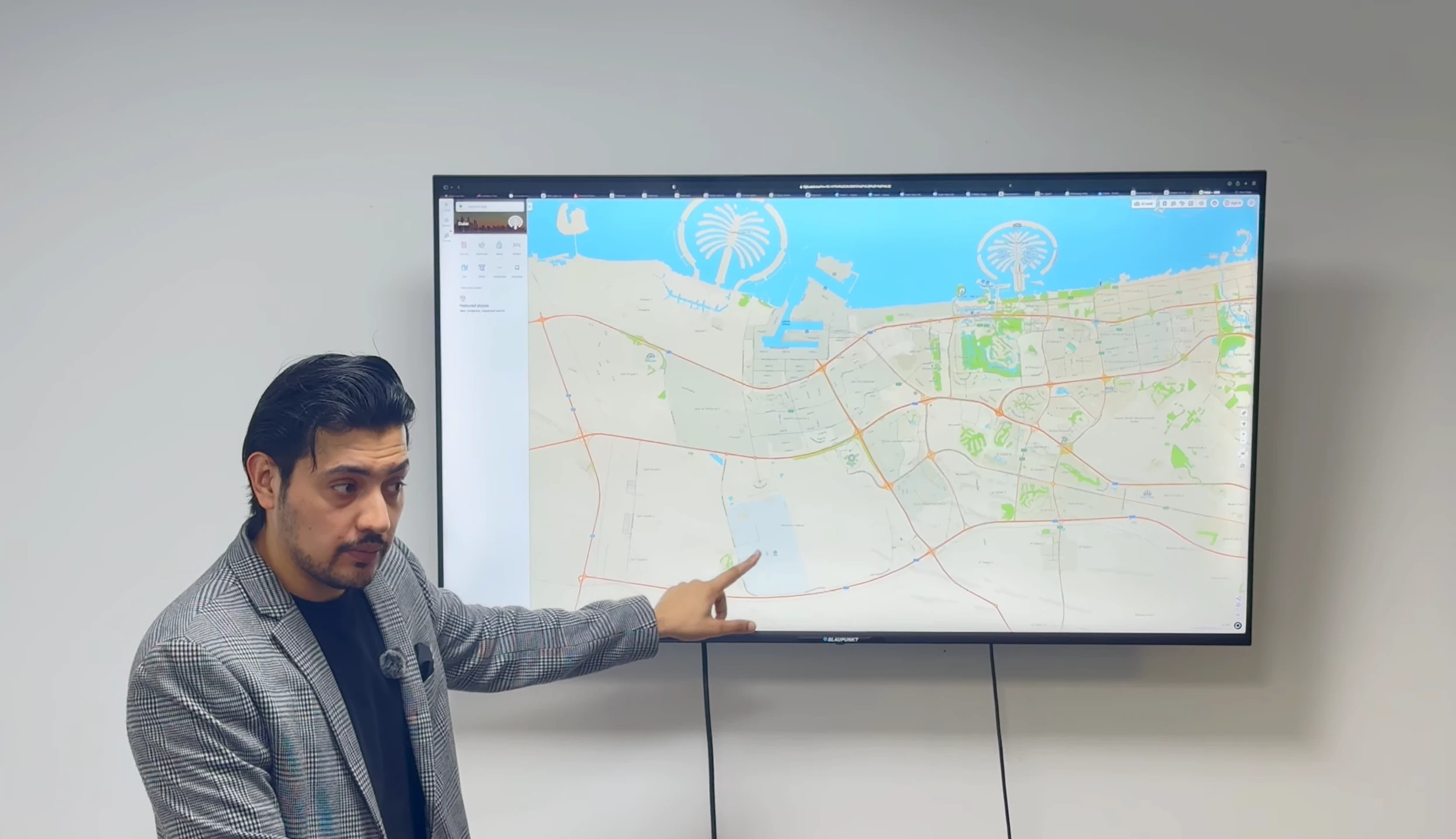

In the constantly evolving landscape of Dubai Real Estate, the most lucrative opportunities are rarely found in the established districts where prices have already peaked. They are found in the emerging corridors where huge infrastructure spending intersects with a new strategic vision. Hado, the inaugural residential project in the Siora community on Dubai Islands, represents exactly this kind of structural arbitrage opportunity. Developed by Beyond, the powered by Omniyat brand designed to bring ultra luxury standards to a wider market, this project is not merely a residential launch. It is a stake in the New North of Dubai. For the past two decades, the center of gravity in the city has pulled south towards the Palm Jumeirah and Dubai Marina. Today, with the opening of the Infinity Bridge and the massive AED 5.3 Billion Al Shindagha Corridor upgrade, the focus has shifted back to the historic coastline, making Dubai Islands the most critical waterfront master plan of the next decade.

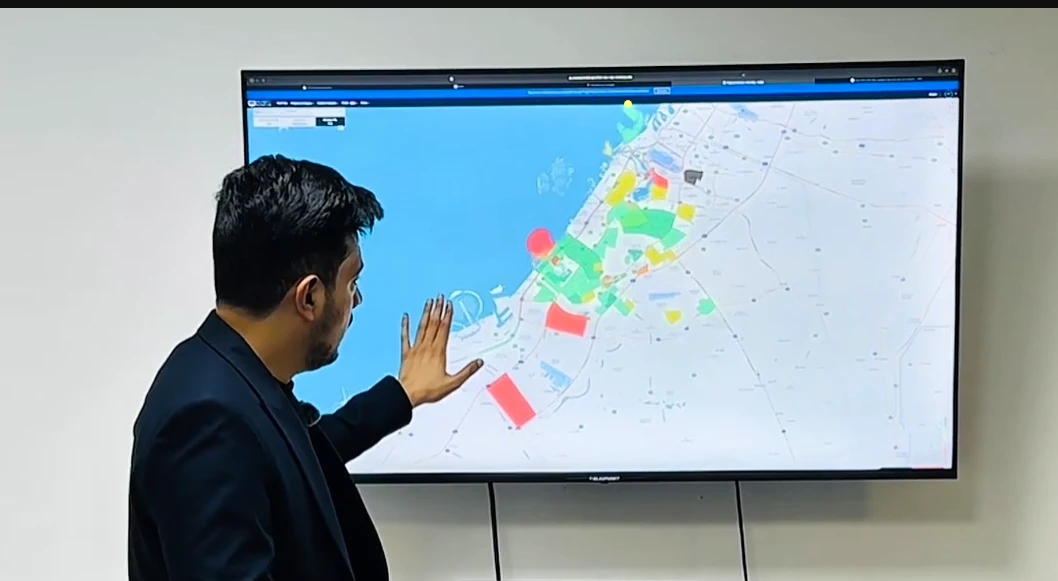

To understand the specific investment value of Hado, one must first dissect the geography of Dubai Islands itself. To the untrained eye, the archipelago may look like a singular development, but for the strategic investor, the distinction between Island A and Island B is the difference between a mass market asset and a legacy asset. Island A is designed as the high density commercial gateway, set to house approximately 31,000 residential units, a massive mall comparable to Dubai Mall, and the bulk of the traffic for the district. While convenient, it is dense. In sharp contrast, Hado is located on Island B, specifically within the exclusive Siora enclave. Island B is designed for privacy, luxury, and retreat, slated to host only around 6,300 units. This is roughly five times less density than Island A. By positioning Hado here, Beyond has secured a location that offers the connectivity of the master plan without the noise and congestion, effectively creating a VIP Zone that will historically command higher resale premiums per square foot.

The architecture of Hado is a direct reflection of this exclusive positioning. Drawing its name from the Japanese concept of Hado, meaning the subtle life force energy or vibration present in all matter, the project rejects the typical glass box aesthetic of the Dubai skyline. Instead, it features three stunning towers defined by the concept of Stillness in Motion. The design utilizes stacked, horizontal tiers and curved glass corners to dissolve the boundaries between the interiors and the horizon, maximizing natural light and offering 360 degree views that capture the open Arabian Gulf, the glittering Downtown Skyline, and the heritage of Mina Rashid. The ground plane is equally impressive. Rather than a concrete podium, residents arrive at a biophilic sanctuary. A lush and landscaped forest featuring over 2,000 trees creates a microclimate that lowers temperatures and filters noise, providing a resort style arrival experience that includes a sculptural drop off and a triple height lobby clad in bronze and natural stone.

From a financial perspective, Hado presents a compelling case for value investing. The current waterfront market in Dubai is trading at all time highs, with prime units on the Palm Jumeirah often exchanging hands above AED 5,000 per square foot. Hado is launching at an average of approximately AED 3,000 per square foot. This represents a significant price anomaly and a discount of nearly 40% for a comparable beachfront lifestyle, simply because the location is in its early growth phase. When we compare Hado to other recent launches, the value becomes even clearer. Passo, another Beyond project on the Palm, trades at over AED 5,000 per square foot. Even within Dubai Islands, projects on the denser Island A are trading at competitive or higher rates despite having inferior beach access. Hado sits on the First Beach Row, granting residents direct access to the 21 kilometer open bay beaches of Dubai Islands, a scarcity factor that ensures inelastic rental demand.

Speaking of rental performance, we have modeled the projected yields for Hado based on existing Proxy Assets like Oceana on the Palm Jumeirah. Despite being an older building, Oceana commands massive rents due to its island location and beach facilities. Applying similar metrics to Hado, but adjusting for its brand new condition and Omniyat grade finishing, we project net rental yields between 6.7% and 8.6% upon the Q3 2029 handover. This yield is further protected by the Omniyat brand premium. In Dubai, branded residences or properties managed by top tier developers consistently outperform generic stock in both occupancy rates and tenant retention. Beyond brings the same engineering DNA, facility management standards, and attention to detail as Omniyat’s ultra luxury masterpieces like The Opus and One Palm, ensuring that the asset remains pristine for decades.

The lifestyle amenities at Hado are designed to render 5 star hotels obsolete for its residents. The podium features a sea view infinity pool that visually merges with the ocean, a Zen Lounge with sunken seating and fire pits for evening socialization, and a dedicated wellness center. The Japanese influence permeates the wellness offering, with a yoga studio defined by rice paper screens and warm oak timber, a cigar lounge with deep leather aesthetics, and a Chef’s Kitchen for private resident events. This focus on holistic living is becoming a primary driver for high net worth tenants who prioritize mental well being alongside luxury.

Finally, the payment plan and timeline offer a strategic leverage play. Hado operates on a 50/50 payment structure. This means 50% is paid in installments during the construction phase, and the remaining 50% is due upon completion in Q3 2029. This long gestation period is a benefit and not a drawback. It allows investors to ride the capital appreciation curve of the entire Dubai Islands master plan, including the opening of the golf courses, the marina, and the mall, while only having deployed half of their capital. Furthermore, with the government's long term plan to transition airport operations from DXB to Al Maktoum International (DWC), the flight path over the northern islands is expected to diminish over the next decade, removing the only historical objection to the area and unlocking a second wave of value growth. Hado is not just a home. It is a legacy asset positioned at the very beginning of a new real estate super cycle in the New North of Dubai.

Complete Property Specifications

Comprehensive property features and finishes

Flooring

Oak Wood & Stone

Wall Finishes

Matte Soft White Paint with Raked Veneer Feature Walls

Door Type

Full-Height Solid Wood with Bronze Hairline Hardware

Window Type

Panoramic Bronze-Tinted Glass

Ali Faizan Sayed's Investment Analysis

RERA Certified Investment Consultant with 10 Years Experience

My Personal Recommendation

"With over 10 years of experience and 512M+ AED in closed deals, I've personally analyzed this project from both technical and investment perspectives. The combination of Beyond (Powered by Omniyat)'s proven track record, Siora, Island B, Dubai Islands's strategic importance, and current market conditions makes this one of my top recommendations for UHNWI investors in 2025."

Why I Personally Recommend This

- The Center of Gravity is Shifting. Don't Look Where the Market is Today; Look Where it is Going Tomorrow." In my 10 years of advising high-net-worth individuals on Dubai real estate, the most common mistake I see is investors chasing yesterday's winners. They buy into Downtown or the Palm Jumeirah after the massive appreciation has already happened. They pay premium prices for "safety," sacrificing the exponential growth that comes from identifying a structural shift in the city's geography. My recommendation for Hado by Beyond is rooted in one simple thesis: The Rise of the New North. For two decades, Dubai expanded South towards Jebel Ali. That expansion is now physically capped. The city is now pivoting back to its historic coastline in the North. Dubai Islands is not just another development; it is an archipelago the size of a small city, backed by the full weight of the Dubai Government's 2040 Master Plan. Investing in Hado today is equivalent to investing in the Palm Jumeirah in 2004. You are securing a "First Beach Row" asset before the rest of the world realizes the magnitude of the destination. Why Hado Specifically? I recommend Hado because it solves the "Quality vs. Price" equation that frustrates so many of my clients. Usually, if you want Omniyat-level finishing—the kind you see at The Opus or One Palm—you have to pay AED 5,000+ per square foot. Hado offers you that same engineering DNA, that same obsession with "Japandi" minimalism and tactile luxury, for approximately AED 3,000 per square foot. This is a value gap that simply should not exist, and it will not last long. Furthermore, I specifically recommend Hado because of its location on Island B (Siora). I always tell my investors to avoid "mass market" zones if they want premium resale values. Island A is the mass market gateway; it is dense, busy, and commercial. Island B is the sanctuary. By choosing Hado, you are insulating your asset from oversupply and noise, ensuring that when you eventually sell or rent, you are offering a product that feels exclusive, private, and rare. The Strategy: This is not a flip. Do not buy Hado if you want to sell in 6 months. I recommend this as a 5-Year Equity Play. Use the 50/50 Payment Plan to your advantage. Pay 50% slowly over the construction period, allowing the infrastructure of Dubai Islands (the mall, the bridges, the golf courses) to mature. By the time you take the keys in Q3 2029, you will be holding a prime waterfront asset in a fully developed master community, likely sitting on significant capital appreciation. Final Verdict: This is a conviction buy for the patient, sophisticated investor who wants legacy quality at an early-cycle price point.

- I project a minimum of 60% capital appreciation by the 2029 handover. This is driven by the completion of the Dubai Islands infrastructure and the natural price equalization with other waterfront districts.

- "Real estate is not 'One Size Fits All'. Hado is a specific product for a specific type of mindset. Are you the right fit?" Identifying the correct investor profile is critical. Hado by Beyond is not a commodity product; it is a lifestyle asset. Based on the pricing, the timeline, and the "Japandi" philosophy, here is the ideal profile of the buyer who will see the most success with this investment. 1. The "Legacy" Wealth Builder This investor is not looking for a quick flip. They are looking to build a portfolio of high-quality assets to hold for 10-15 years. They understand that Omniyat buildings are "Collector's Items." Just as The Opus has become an architectural landmark, Hado is poised to become the aesthetic benchmark for Dubai Islands. This investor buys Hado to secure a foothold in the "New North" for their children or their future retirement, knowing that the asset's physical quality will not degrade over time. 2. The "Wellness-Conscious" End User Post-pandemic, there is a massive demographic of residents in Dubai who are tired of the "Bling" and the noise. They find Downtown too chaotic and the Palm too congested. This buyer is seeking "Quiet Luxury." They value mental health, silence, and nature. Hado’s focus on Hado (Life Force), its 2,000-tree forest podium, its yoga studios, and its open ocean views appeals directly to this sophisticated demographic. They are buying a home, not just a unit. 3. The "Smart Leverage" Investor This profile is financially savvy. They look at the 50/50 Payment Plan and see an interest-free leverage opportunity. They understand that by paying only 50% over the next 5 years, they are effectively controlling a high-value asset with minimal capital exposure. They plan to take a mortgage on the final 50% at handover (Q3 2029), allowing the tenant to pay off the mortgage while they enjoy the capital appreciation on the full asset value. This is the "Return on Equity" (ROE) play. 4. The Golden Visa Seeker With prices starting around AED 1.8 Million and quickly moving into the AED 2 Million+ bracket for premium units, Hado is a perfect vehicle for the 10-Year UAE Golden Visa. This investor wants stability. They want to park their funds in a USD-pegged economy, secure residency for their family, and own a liquid asset that is easy to rent out. The waterfront location ensures high rental demand, making it a safe "Visa + Yield" vehicle. 5. The "Holiday Home" Operator Dubai Islands is destined to be a tourism hub with 86 hotels. This makes Hado a prime candidate for Short-Term Rental (Airbnb). The tourist who comes to Dubai Islands wants beach access. They want resort amenities. Hado offers this. An investor focused on high yields will furnish this unit to a 5-star standard and market it as a "Japanese Wellness Retreat" on Airbnb, likely outperforming long-term rental yields by 20-25%. Who is this NOT for? This is not for the speculator looking to sell the contract in 3 months for a 20% premium. The value here is built over time. It requires patience to let the island mature.

- Every off-plan investment carries risk. As your advisor, my job is not to hide these risks, but to expose them so we can determine if the "Reward" justifies them. For Hado by Beyond, I classify the risk level as Low-Medium. Here is the detailed breakdown of the potential headwinds and the structural mitigations in place. Risk 1: The "New Location" Uncertainty The Concern: Dubai Islands (formerly Deira Islands) has a history of delays under previous master plans. Some investors worry if the destination will truly rival the Palm or Marina. The Mitigation: The master developer is now Nakheel (under Dubai Holding), the government-backed entity responsible for the Palm Jumeirah. The infrastructure is already visible—the Infinity Bridge is open, the Souk Al Marfa is operational, and the beaches are open to the public. The "ghost project" risk is gone; this is an active, government-priority zone. Risk 2: Construction Timeline (Q3 2029) The Concern: A 2029 handover is a long wait. In Dubai, long timelines can sometimes lead to fatigue or project stalls. The Mitigation: Omniyat is the developer. While they are known for taking their time to perfect a building, they always deliver, and they deliver to a standard that often exceeds the initial renders. The long timeline here is actually a strategic benefit. It aligns the handover of your unit with the maturity of the wider Island B infrastructure. You do not want to take handover in a construction site; you want to take handover in a finished community. The long build time ensures this synchronization. Risk 3: Airplane Noise The Concern: North Dubai is traditionally closer to the DXB flight path. The Mitigation: This is the most common objection I hear. First, Island B (Siora) is geographically offset from the direct runway approach compared to Island A, significantly reducing decibel levels. Second, and most importantly, the Dubai Government has officially announced the transition of operations to Al Maktoum International Airport (DWC) in the South over the next decade. By the time you are living in or renting out Hado in the 2030s, the flight path issue will likely be obsolete, turning a current "negative" into a massive future "value unlock." Risk 4: Market Oversupply The Concern: Will there be too many units on Dubai Islands? The Mitigation: This is why we buy on Island B. Island A is high density (30,000+ units). Island B is low density (~6,000 units). By positioning your capital in Hado, you are buying into the "Scarcity Zone" of the master plan. Luxury tenants always gravitate towards lower-density enclaves, protecting your future rental yields from mass-market competition. Conclusion: The risks are macro-level (market cycles), not project-specific. The developer is Tier-1, the land is freehold, and the payment plan is defensive. The risk-to-reward ratio is heavily skewed in your favor.

Risk Mitigation Strategy

- Every off-plan investment carries risk. As your advisor, my job is not to hide these risks, but to expose them so we can determine if the "Reward" justifies them. For Hado by Beyond, I classify the risk level as Low-Medium. Here is the detailed breakdown of the potential headwinds and the structural mitigations in place. Risk 1: The "New Location" Uncertainty The Concern: Dubai Islands (formerly Deira Islands) has a history of delays under previous master plans. Some investors worry if the destination will truly rival the Palm or Marina. The Mitigation: The master developer is now Nakheel (under Dubai Holding), the government-backed entity responsible for the Palm Jumeirah. The infrastructure is already visible—the Infinity Bridge is open, the Souk Al Marfa is operational, and the beaches are open to the public. The "ghost project" risk is gone; this is an active, government-priority zone. Risk 2: Construction Timeline (Q3 2029) The Concern: A 2029 handover is a long wait. In Dubai, long timelines can sometimes lead to fatigue or project stalls. The Mitigation: Omniyat is the developer. While they are known for taking their time to perfect a building, they always deliver, and they deliver to a standard that often exceeds the initial renders. The long timeline here is actually a strategic benefit. It aligns the handover of your unit with the maturity of the wider Island B infrastructure. You do not want to take handover in a construction site; you want to take handover in a finished community. The long build time ensures this synchronization. Risk 3: Airplane Noise The Concern: North Dubai is traditionally closer to the DXB flight path. The Mitigation: This is the most common objection I hear. First, Island B (Siora) is geographically offset from the direct runway approach compared to Island A, significantly reducing decibel levels. Second, and most importantly, the Dubai Government has officially announced the transition of operations to Al Maktoum International Airport (DWC) in the South over the next decade. By the time you are living in or renting out Hado in the 2030s, the flight path issue will likely be obsolete, turning a current "negative" into a massive future "value unlock." Risk 4: Market Oversupply The Concern: Will there be too many units on Dubai Islands? The Mitigation: This is why we buy on Island B. Island A is high density (30,000+ units). Island B is low density (~6,000 units). By positioning your capital in Hado, you are buying into the "Scarcity Zone" of the master plan. Luxury tenants always gravitate towards lower-density enclaves, protecting your future rental yields from mass-market competition. Conclusion: The risks are macro-level (market cycles), not project-specific. The developer is Tier-1, the land is freehold, and the payment plan is defensive. The risk-to-reward ratio is heavily skewed in your favor.

- Risk Level: low

- I have spent considerable time analyzing the master plan for Island B. The difference in density compared to Island A is staggering. Island B feels like a private retreat. When I walked the site, looking at the open ocean, I realized that Hado isn't just selling an apartment; it's selling silence and space the two ultimate luxuries in a bustling city.

Detailed Investment Insights

My professional analysis based on 10 Years experience and market research

Location

Insight: "The strategic separation of Island B (Siora) from Island A is the most critical value driver. While Island A acts as the commercial engine (Mall, Traffic, Density), Island B acts as the residential sanctuary." Deep Dive: You get the benefit of the infrastructure without the burden of the noise. Island B has 5x lower density than Island A. In luxury real estate, exclusivity is the primary driver of price retention. By buying here, you are effectively buying into a gated community on the water, protected from the mass-market supply.

Developer

Insight: "Omniyat is the 'Apple' of Dubai Real Estate. Their assets (The Opus, One Palm) hold value better than almost anyone else in the market." Deep Dive: Properties managed or developed by Omniyat historically command a 20-30% rental and resale premium over neighboring buildings. The "Beyond" brand is simply their vehicle to bring this engineering excellence to a wider demographic. You are buying "Ultra-Luxury" specs (3.2m ceilings, marble, bronze) at "Premium" market prices. This built-in quality buffer protects your equity during market softenings.

ROI

"We project a blended return: 8-9% Net Rental Yield (driven by beach scarcity) + 40% Capital Appreciation (driven by early entry)." Deep Dive: Beachfront properties in Dubai have inelastic demand. Tenants will always pay more for the view and the lifestyle. Currently, Hado is priced at ~AED 3,000 psf. Comparable mature beachfront assets trade at AED 4,500+. As Dubai Islands connects fully to the city grid, Hado's price will naturally gravitate towards that upper benchmark.

Market Timing

"Buying Phase 1 of a Master Plan is the Golden Rule of Dubai Real Estate. Prices are lowest now; they will only rise with subsequent launches." Deep Dive: We have tracked developer pricing behavior across Dubai. On average, developers increase prices by 15-20% between Phase 1 and Phase 2. By entering Hado now, you are locking in the "Founder's Price." You are buying the future potential of Siora at today's raw construction cost.

Infrastructure

"The Al Shindagha Corridor and Infinity Bridge have solved the historic 'Deira Traffic' problem, unlocking the true value of the North." Deep Dive: Accessibility was the only thing holding this area back. That barrier is now removed. You are 19 minutes from the airport and 26 minutes from Downtown. Furthermore, the future relocation of the airport flight path to Al Maktoum (DWC) will remove noise pollution, triggering a secondary value spike in the 2030s.

Amenities

"Biophilic design and 'Quiet Luxury' are the new trend. Amenities that focus on mental health (Zen Lounges, Forests) will outperform generic 'bling' amenities." Deep Dive: The market is flooded with "party towers." Hado offers an antidote. The 2,000-tree forest podium, the Japanese tea house concepts, and the wellness spa cater to a growing demographic of high-income tenants who value peace. This unique selling proposition (USP) ensures your asset stands out in a crowded rental market.

Who Should Invest in This Property?

"Real estate is not 'One Size Fits All'. Hado is a specific product for a specific type of mindset. Are you the right fit?" Identifying the correct investor profile is critical. Hado by Beyond is not a commodity product; it is a lifestyle asset. Based on the pricing, the timeline, and the "Japandi" philosophy, here is the ideal profile of the buyer who will see the most success with this investment. 1. The "Legacy" Wealth Builder This investor is not looking for a quick flip. They are looking to build a portfolio of high-quality assets to hold for 10-15 years. They understand that Omniyat buildings are "Collector's Items." Just as The Opus has become an architectural landmark, Hado is poised to become the aesthetic benchmark for Dubai Islands. This investor buys Hado to secure a foothold in the "New North" for their children or their future retirement, knowing that the asset's physical quality will not degrade over time. 2. The "Wellness-Conscious" End User Post-pandemic, there is a massive demographic of residents in Dubai who are tired of the "Bling" and the noise. They find Downtown too chaotic and the Palm too congested. This buyer is seeking "Quiet Luxury." They value mental health, silence, and nature. Hado’s focus on Hado (Life Force), its 2,000-tree forest podium, its yoga studios, and its open ocean views appeals directly to this sophisticated demographic. They are buying a home, not just a unit. 3. The "Smart Leverage" Investor This profile is financially savvy. They look at the 50/50 Payment Plan and see an interest-free leverage opportunity. They understand that by paying only 50% over the next 5 years, they are effectively controlling a high-value asset with minimal capital exposure. They plan to take a mortgage on the final 50% at handover (Q3 2029), allowing the tenant to pay off the mortgage while they enjoy the capital appreciation on the full asset value. This is the "Return on Equity" (ROE) play. 4. The Golden Visa Seeker With prices starting around AED 1.8 Million and quickly moving into the AED 2 Million+ bracket for premium units, Hado is a perfect vehicle for the 10-Year UAE Golden Visa. This investor wants stability. They want to park their funds in a USD-pegged economy, secure residency for their family, and own a liquid asset that is easy to rent out. The waterfront location ensures high rental demand, making it a safe "Visa + Yield" vehicle. 5. The "Holiday Home" Operator Dubai Islands is destined to be a tourism hub with 86 hotels. This makes Hado a prime candidate for Short-Term Rental (Airbnb). The tourist who comes to Dubai Islands wants beach access. They want resort amenities. Hado offers this. An investor focused on high yields will furnish this unit to a 5-star standard and market it as a "Japanese Wellness Retreat" on Airbnb, likely outperforming long-term rental yields by 20-25%. Who is this NOT for? This is not for the speculator looking to sell the contract in 3 months for a 20% premium. The value here is built over time. It requires patience to let the island mature.

My Personal Experience with Similar Projects

I have spent considerable time analyzing the master plan for Island B. The difference in density compared to Island A is staggering. Island B feels like a private retreat. When I walked the site, looking at the open ocean, I realized that Hado isn't just selling an apartment; it's selling silence and space the two ultimate luxuries in a bustling city.

Ready to Discuss This Investment?

Let's schedule a personal consultation where I can share more detailed insights, show you comparable projects, and create a customized investment strategy.

Unit Types & Configurations

Explore floor plans, layouts, and investment potential

🏠1 Bedroom Residence1br

Unit Specifications

Investment Opportunity Dashboard

Professional ROI analysis and market intelligence

Investment Parameters

Investment Returns

Enhanced Payment Calculator

Smart payment planning with multiple financing options

Select Your Unit

1 Bedroom Residence

1

AED 2,400,000

2 Bedroom Residence

2

AED 3,500,000

3 Bedroom Residence

3

AED 5,800,000

Choose Payment Plan

Flexible Payment Plan

Extended timeline with manageable payments

Accelerated Payment Plan

Quick completion with attractive discounts

Investor-Friendly Plan

Optimized for maximum leverage

Payment Schedule - Flexible Payment Plan

Based on unit price: AED 2,400,000

Down Payment

Construction Payments

Final Payment

Ready to Secure Your Investment?

Get personalized payment options and secure the best available unit. Our finance specialists can help optimize your investment structure.

Media Gallery

Explore property images and video content

HADO by Beyond,

Video 1 of 2

Available Tours

HADO by Beyond,

HADO by Beyond

Watch complete video tours of Hado - Siora Community at Dubai Islands

Comprehensive Location Analysis

Deep dive into Siora, Island B, Dubai Islands's investment potential, infrastructure, and lifestyle advantages

Developer Reputation Analysis

Understanding Beyond (Powered by Omniyat)'s track record and how it impacts your investment

Risk Assessment

Market Intelligence by Ali Faizan

Expert market analysis and investment predictions

My Market Analysis & Predictions

"Based on my decade of experience analyzing Siora, Island B, Dubai Islands's market dynamics, infrastructure pipeline, and demographic trends, I project this area will emerge as one of Dubai's premium investment destinations by 2027. The timing couldn't be better for strategic UHNWI investors."

Investment Timeline Predictions

My forecasts for different investment horizons

1–2 Years

Steady appreciation, strong rental demand driven by economic growth

3–5 Years

Significant growth due to infrastructure completion and area maturity

5–10 Years

Premium location status established, peak investment returns

Key Market Drivers I'm Watching

Infrastructure Development

Metro extensions, new highways, and smart city initiatives underway

Population Growth

Professional expat influx, growing high-income community

Government Initiatives

Golden visa, 100% foreign ownership, business-friendly policies

Economic Diversification

Post-pandemic recovery, tourism boom, business hub expansion

Risk Assessment & Mitigation

Market Oversupply

Prime location insulates from general market fluctuations

Interest Rate Changes

Fixed-rate financing options available

Construction Delays

Developer's strong track record minimizes risk

Economic Downturn

Dubai's diversified economy provides resilience

Get Detailed Market Report

Want deeper insights? I can provide a comprehensive market analysis report with detailed comparables, ROI projections, and strategic recommendations.

Dubai Market Intelligence & Trends

Expert analysis of market conditions, pricing trends, and optimal investment timing

Property Amenities

Interactive Map

Siora, Island B, Dubai Islands

Open in Maps App

Coordinates: 25.297800, 55.338900

Nearby Attractions & Amenities

Explore what makes Siora, Island B, Dubai Islands exceptional

away

Dubai Islands Beach

away

Future Dubai Islands Mall

away

Dubai Int'l Airport

Available Units

Browse individual units with detailed specifications

Available Units

462 of 462 units available

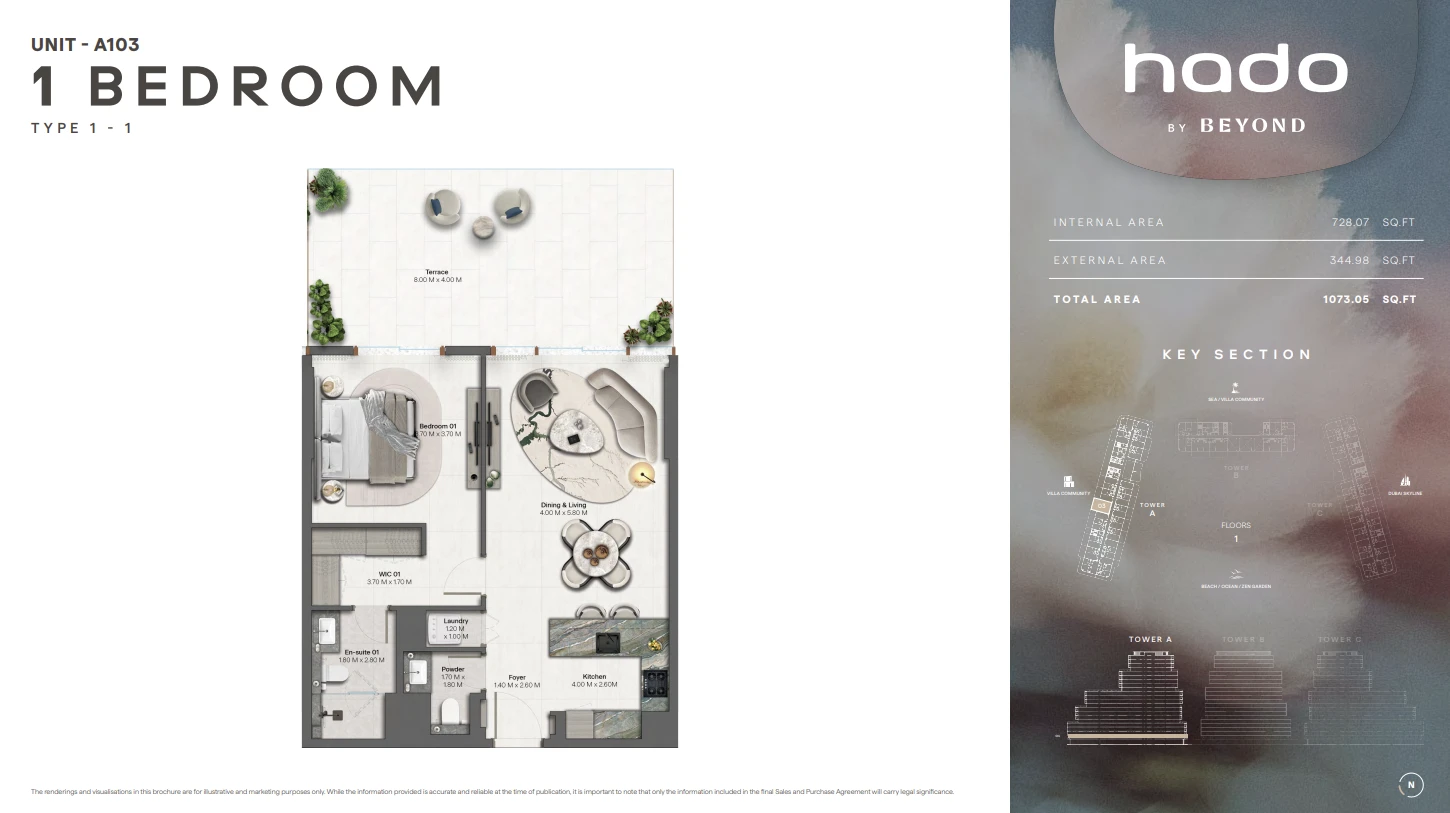

Unit A-101

1 Bedroom Residence

Unit A-102

1 Bedroom Residence

Unit A-103

1 Bedroom Residence

Unit A-104

1 Bedroom Residence

Unit A-105

1 Bedroom Residence

Unit A-106

1 Bedroom Residence

How to Invest in Hado - Siora Community at Dubai Islands

Step-by-step guide to investing in Hado - Siora Community at Dubai Islands by Beyond (Powered by Omniyat)

Required Documents:

Tools Needed:

Schedule Consultation

Book a free consultation with our Dubai real estate experts to discuss your investment goals and property requirements.

Property Tour & Analysis

Visit the property location and review detailed investment analysis including ROI projections, payment plans, and market comparison.

Documentation & Payment

Submit required documents (passport, visa, Emirates ID if applicable) and pay booking amount of AED 240,000.

SPA & Registration

Sign Sale and Purchase Agreement (SPA) with developer, complete registration with Dubai Land Department, and begin payment plan.

Similar Projects in Prime Locations

Explore comparable investment opportunities in Dubai's most sought-after neighborhoods

Investment Insights & Guides

Expert analysis and market insights to guide your investment decisions

The 142% Gap: Why The Oasis by Emaar is the Smartest Buy vs. District One

Everyone is talking about District One, but the smart money is looking at the numbers. I’ve analyzed the price-per-sq-ft, and The Oasis offers a 142% value gap. Here is why this is the "gift" the market has been waiting for.

The Price of Hesitation: Why Delaying Your Dubai Real Estate Investment Costs You 0.88% Every Month

In a market where developers sell out in two hours, hesitation is the biggest expense. Drawing on precise Q1 2025 data, I break down the cost of waiting an increase of 0.88% per month and why using logic and numbers is the only way to capitalize on Dubai's unprecedented growth.

Why Less Than 2% of Dubai Properties Have Direct Beach Access

Ali Faizan Syed explains the geographic scarcity driving Ultra Luxury prices: only 7% of Dubai is waterfront, and less than 2% has direct beach access. Learn how this rarity affects HNI investment strategy.

Frequently Asked Questions

Project-specific questions and answers

general

Still Have Questions?

Our real estate experts are available to provide personalized answers and detailed information about this investment opportunity.