The Problem: When Price Doesn't Just Mean Quality

Clients often assume that the price difference between a medium-category property (like one in JVC selling for 1,600 AED PSF) and an ultra-luxury property is solely based on finishings or design. While quality matters, the exponential jump in price sometimes reaching 50 million AED is primarily due to an irreplaceable asset: the location.

The Challenge: How do we logically justify a massive price tag to an HNI investor?

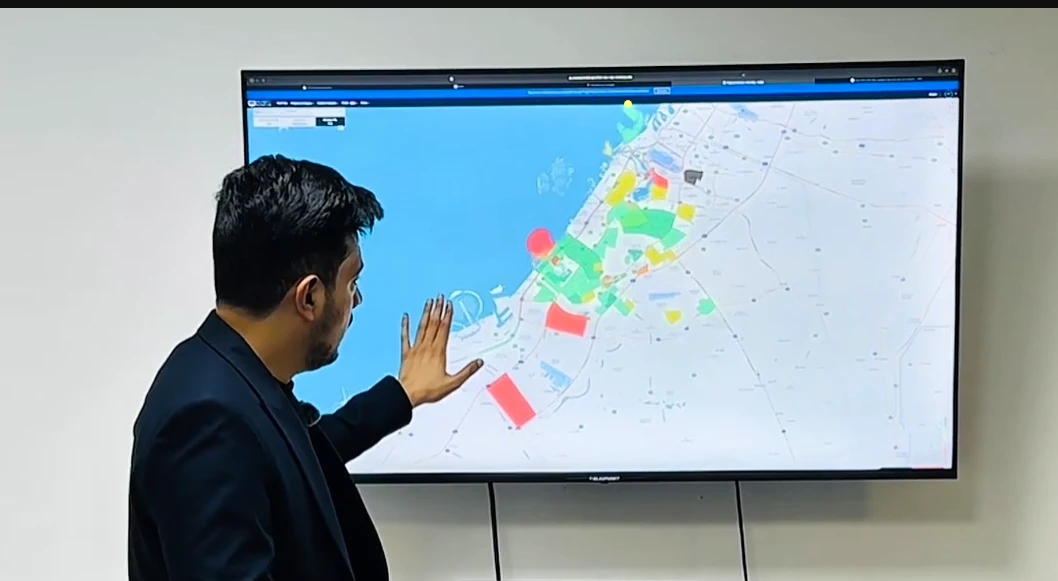

The Action: We must present the hard numbers on geographic limitations, demonstrating that the asset they are buying is extremely limited:

- Waterfront Limitation: Start with the fact that approximately 7% of Dubai has waterfront. This includes the coastline, creeks, and canals.

- Direct Access Rarity: Narrow the focus to the most desirable asset: direct, usable beach access. The data confirms that less than 2% of the properties in Dubai have this direct access.

The Result: This profound scarcity drives the market. When you understand that 98% of the market cannot compete on location, the price premium for the Ultra Luxury category makes complete, logical sense.

The Ultra-Luxury Divide: Palm Jumeirah vs. Palm Jebel Ali

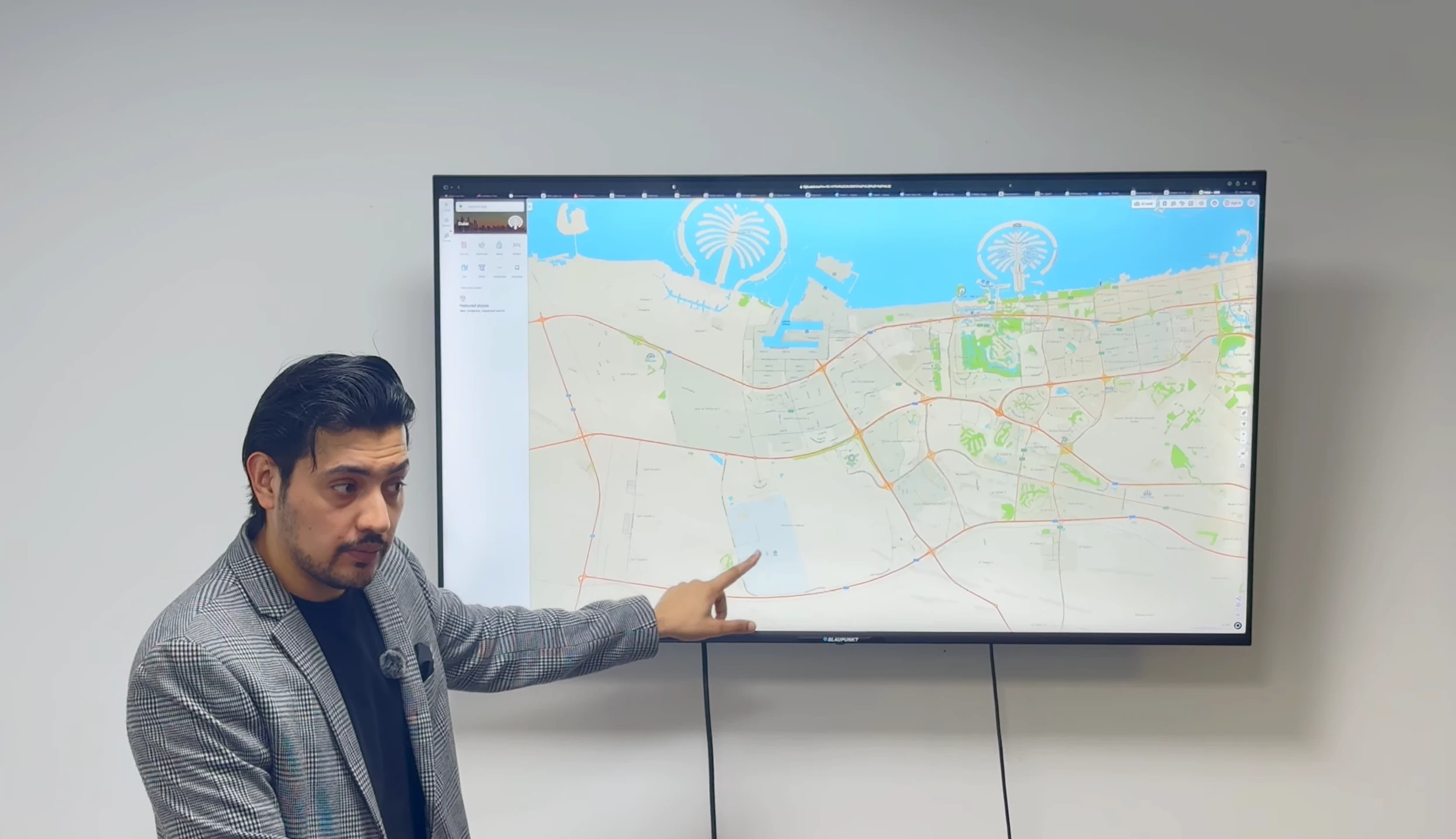

The best way to illustrate the power of infrastructure in the luxury market is by comparing established zones with emerging ones.

The Challenge: An investor with 50 million AED has a choice: invest in a ready asset in an established luxury area or take a calculated risk on a new one.

The Action: We compare two similar, high-profile projects: Palm Jumeirah and Palm Jebel Ali.

- Palm Jumeirah: This area is mature and serves as the current benchmark for waterfront living.

- Palm Jebel Ali: This is the emerging ultra-luxury area.

I ask clients, "Rather than buying anything in Palm Jumeirah for the 50 or 70 or 100 million, I could invest in Palm Jebel Ali, right? I could get two plots, two villas for the same price".

The Result: The difference between the ready asset (Palm Jumeirah) and the future asset (Palm Jebel Ali) is purely infrastructure. The HNI is essentially deciding whether to pay a full premium for existing infrastructure or buy cheaper plots now and wait for the massive infrastructure to arrive and realize guaranteed capital appreciation. This decision falls firmly under the "Luxury" or "Ultra" category.

Categorization: The Luxury vs. Lower Investment Logic

It is essential to distinguish the investment logic used in the Ultra Luxury category from the logic applied to affordable areas like Dubai South.

The Challenge: Sometimes, investors confuse high capital value with high capital appreciation percentage.

The Action: We emphasize that while Ultra Luxury properties command the highest overall price, they operate under different dynamics than low-ticket, high-potential areas:

- Luxury Logic: Focuses on preservation of wealth and geographical scarcity (the <2% beach access).

- Lower Logic: Focuses on percentage growth, leveraging the lowest PSF price (like 1,100 AED in Dubai South) against government-mandated infrastructure (like the DWC airport).

The Result: The categorization Lower, Medium (JVC, Arjan), or Ultra Luxury (Waterfront) determines the expected return profile and the core reason for investment. The Ultra Luxury segment is protected by its innate rarity.

Actionable Takeaways (Summary)

For investors targeting the Ultra Luxury segment in Dubai:

- Quantify Scarcity: Base your investment thesis on the quantifiable geographic rarity: only 7% of Dubai is waterfront, and less than 2% has direct beach access.

- Use Infrastructure as a Filter: When comparing ultra-luxury zones, recognize that the price variance between a mature area (Palm Jumeirah) and a new area (Palm Jebel Ali) is primarily dictated by the presence or absence of infrastructure.

- Confirm Category: Ensure you categorize the investment correctly as Luxury, recognizing its focus on high capital value rather than the low-ticket, high-percentage growth found in the Lower category (Dubai South).

- Reference Development Plans: Note that government announcements, such as those related to Palm Jebel Ali and the future "next marina" (like the area near Dubai Marina), signal where future scarcity and high-value projects will be concentrated.

Conclusion

In the market of Ultra Luxury, your investment is an exclusive entry ticket. The value is intrinsically tied to the fact that over 98% of the market cannot offer what your property does: direct waterfront access. By using precise data on scarcity, we prove that the high price is not arbitrary, but a reflection of limited geography and high demand from HNIs seeking security in the most unique assets the city has to offer.

If scarcity is the key driver of Ultra Luxury, where do you predict the next major non-waterfront land scarcity event will occur in the coming years?