The Price of Hesitation: Why Delaying Your Dubai Real Estate Investment Costs You 0.88% Every Month

In my 10 years of experience navigating the aggressive dynamics of the Dubai real estate market, I’ve learned that the true measure of a professional isn't rhetoric; it's precision. When I ask a broker their age, I expect them to say "39," not "I'm near to my 40s". That simple difference precision over vagueness is what creates power and credibility in communication.

This philosophy is never more critical than when analyzing the current market speed. If you are debating an investment, you must understand that every month you wait, you are literally losing capital appreciation.

The Core Insight

The Dubai market is moving at an unprecedented pace, demonstrated by the nearly 200,000 transactions recorded up to Q1 2025 alone, generating a value approaching 250 billion AED. This volume, coupled with rapid development, means that property prices are increasing by 0.88% every month. Consequently, waiting just six months will force you to pay 5% to 5.5% more for the exact same property, making quick, data-driven decisions mandatory for successful investment.

The Experience-Telling Narrative

The Power of Precision: Benchmarking Dubai's Aggressive Growth

When presenting an opportunity to a client, you must position yourself as an expert who understands the sheer scale of the market. We aren't dealing with average growth; we are witnessing an aggressive acceleration of investment.

The Challenge: Clients often hear general terms like "the market is hot" but lack the specific numbers to feel the urgency required to act quickly.

The Action: We must anchor our conversation in the latest verifiable statistics:

- Current Transaction Volume: Up to Q1 2025, the total number of transactions is near 200,000 (specifically, 189,000 up to 198,000).

- Total Value: This volume translates to a value approaching 250 billion AED (243.700 to 750 billion AED).

- Historical Context: This volume is shocking when compared to the 164,000 transactions recorded in the entire previous year. If the current pace continues, the market will easily surpass last year's total.

The Result: By using these precise numbers, you are not selling hype; you are stating a factual market condition. This is how you create power in your communication and position yourself correctly in front of the client. Furthermore, this dictates the necessity for brokers and investors alike to translate yearly goals into actionable daily plans, knowing exactly "what to do later" and what they plan to achieve after one year.

The Cost of Waiting: Pricing Hesitation into Your Investment

In a market this fast, hesitation is not just a lost opportunity; it's a measurable financial cost.

The Challenge: Clients often believe they have time to think, especially when making a large Dubai real estate investment. However, when developers are selling out entire launches in two or three hours, you are competing against speed, not speculation.

The Action: I emphasize the specific numerical penalties for delaying a decision:

- The average month-over-month price increase is 0.88%.

- This translates to a penalty of 5% to 5.5% more if you wait just six months.

- In some extremely competitive areas, prices have risen up to 10% in six months.

The Result: This simple arithmetic demonstrates that if you have the money and the conviction, "we can make a decision now rather than paying 5.5% or 6% more". This aggressive price appreciation (which hit 4.5% up to 4.8% overall in Q1/Q2 alone) is a direct consequence of the city’s pace and vision.

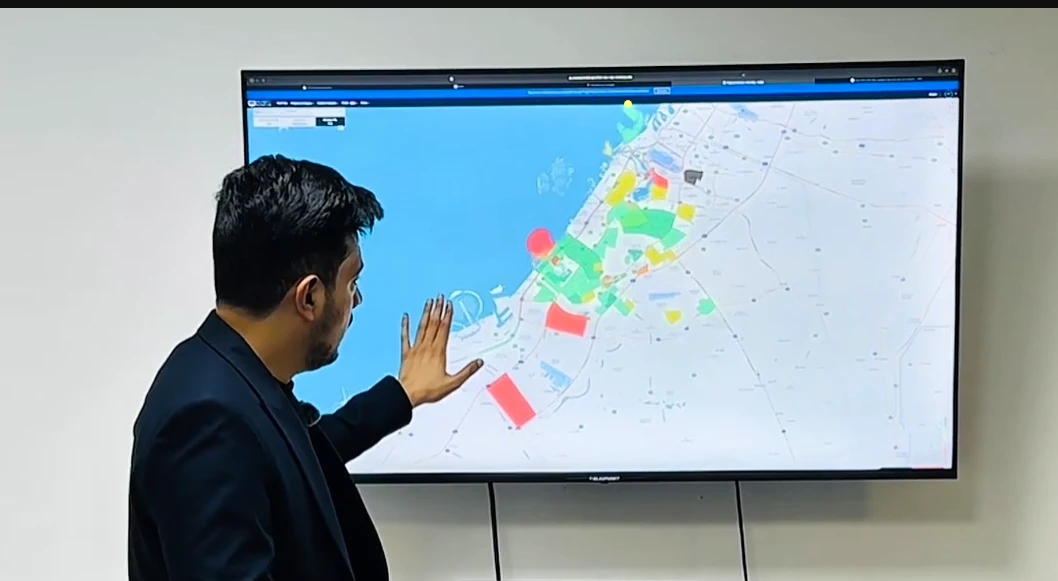

Redefining Time: How Dubai Changed the Investment Clock

IMG;01

The speed of Dubai’s development has literally changed the global definition of real estate investment terms.

The Challenge: Investors coming from international markets rely on traditional definitions, where a "short-term gain" in real estate is typically not less than five years. This leads them to underestimate the required duration for a substantial return.

The Action: We must educate them on the "aggressive" vision of the city's development:

- Global Short-Term: Not less than five years.

- Dubai Long-Term: We call five years long-term.

- Dubai Short-Term: One or two years.

The logic behind the long-term goal of five years is tied to realistic capital appreciation. While industry sources like the Night Frank report suggest a best-case scenario of 16% to 18% annual capital appreciation, we must be realistic. I advise clients to project based on a conservative average of 10% to 12%. This lower, more responsible number ensures that we are giving numbers with logic, minimizing the risk of losing client trust if exaggerated predictions don't materialize.

Actionable Takeaways (Summary)

To invest successfully in this aggressive, data-driven market:

- Embrace Precision: Always use specific data, such as the Q1 transaction volume (near 200,000) and value (near 250 billion AED), to validate market strength.

- Calculate the Cost of Delay: Understand that the monthly price increase of 0.88% translates to paying at least 5% more if you wait six months.

- Validate Sources: Demand statistics from credible private entities, such as the Night Frank report, to verify capital appreciation rates (16% to 18%).

- Set Realistic Long-Term Goals: Define your long-term goal as five years, and calculate returns based on a conservative 10% to 12% annual capital appreciation.

- Focus on Logic: Base every investment pitch on "logic with numbers" to maintain credibility and avoid exaggeration.

Conclusion

Dubai’s real estate market operates under a mandate of speed and precision, defined by a vision that changed the very definition of short-term and long-term investment. Ignoring the continuous price increase of 0.88% per month is a costly mistake. Success is not found by following vague market sentiment, but by mastering the numbers, setting logical goals, and acting decisively before the opportunity costs you 5.5% more.

What is the greatest risk you see to the market continuing its current aggressive pace? Share your data and logic below.