If you have been sitting in my office anytime in the last six months, you know I preach one thing: Value Investing.

In Dubai, it is easy to get caught up in the hype. You see a finished community like District One or Emirates Hills, you see the price tag, and you think, "That’s where I need to be." And don't get me wrong District One is phenomenal. But as an investor, or even a savvy end-user, does it make sense to pay 60 Million AED for a 6-bedroom villa today?

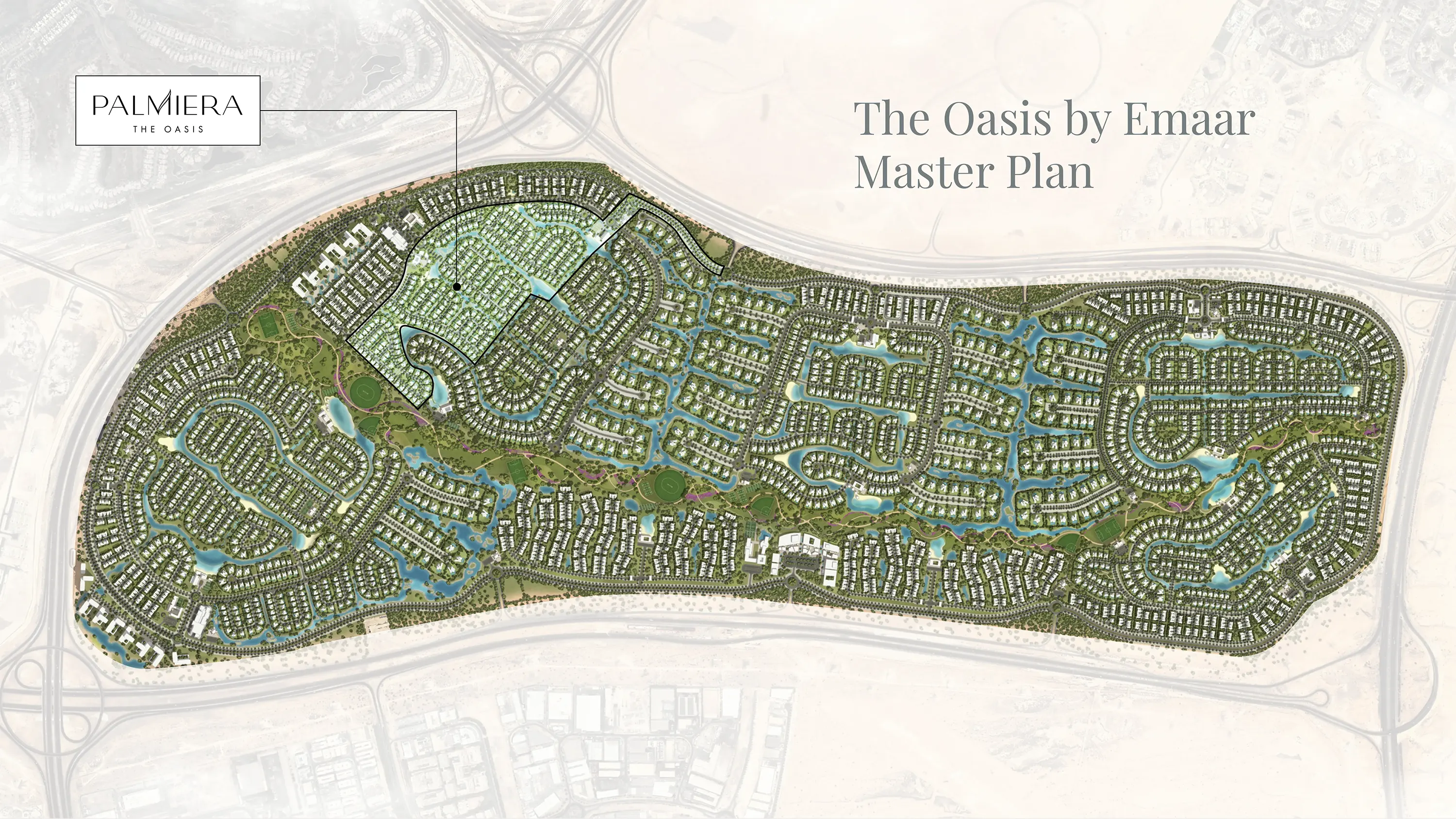

I don't think so. Not when The Oasis by Emaar is sitting right there with a 142% price gap.

Mohamed Alabbar called this project "a gift to the real estate industry." After crunching the numbers on this Palace Villas launch, I can tell you—he isn't exaggerating.

The Math That Nobody Is Talking About

Let’s strip away the glossy brochures and look at the raw data.

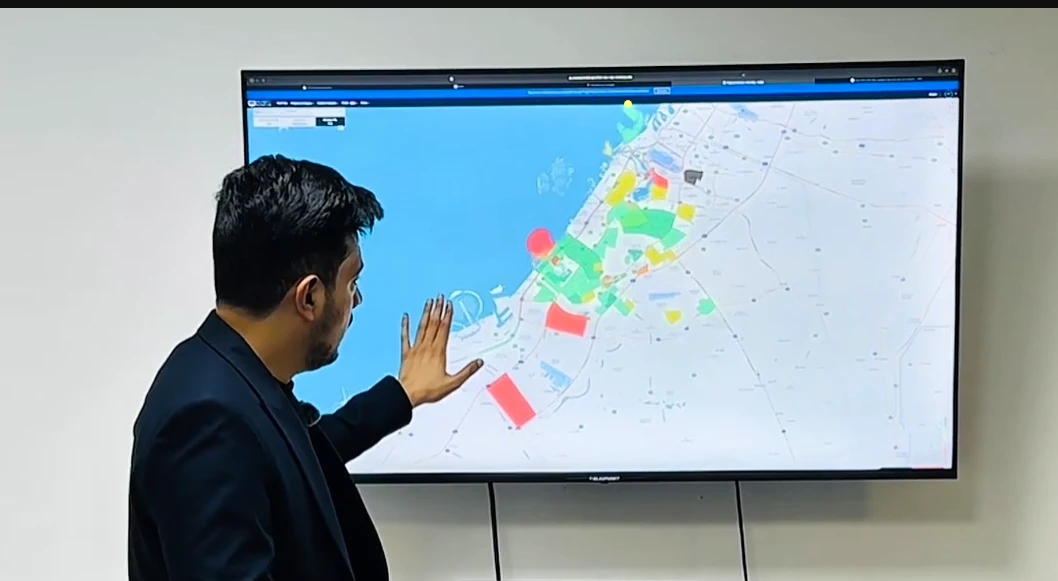

Right now, the luxury villa market in Dubai is suffering from a severe supply shortage. Since Q3 2020, luxury villa prices have jumped by 125%. That is incredible growth. But it also means that established communities are priced at a premium.

The District One Scenario:

- Status: Ready / Near Ready

- Avg. Price (6-Bed): ~61 Million AED

- The Premium: You are paying for the "now."

The Oasis Scenario:

- Status: Off-Plan (Handover 2029)

- Avg. Price (6-Bed Palace Villa): ~24 Million AED

- The Opportunity: You are paying 1,700 AED per sq. ft. for Emaar’s highest-tier brand.

The math is simple. You are getting a brand-new, higher-spec, smart-home-integrated mansion for less than half the price of the competitor.

"But Ali, Isn't it Far?"

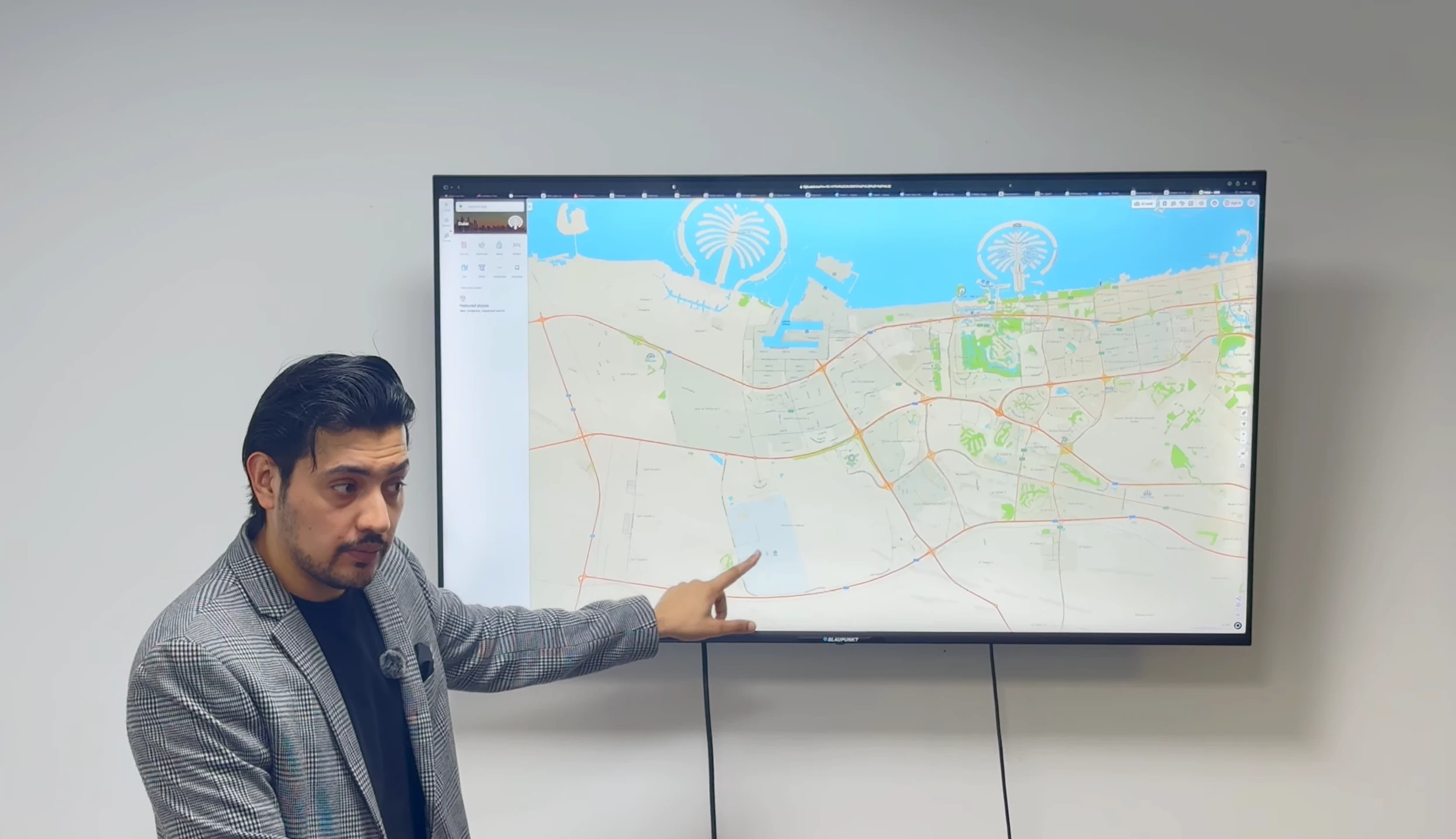

This is the most common objection I hear. "Ali, Dubailand feels far away."

Let me correct that mindset. The Oasis is not far; it is central to the future.

The project sits on a massive 9.4 million square meter plot. It has direct connectivity to Al Khail Road. If you drive in Dubai, you know Al Khail is the lifeline. It bypasses the traffic of Hessa Street and Sheikh Zayed Road.

- District One to Downtown: ~12 Minutes.

- The Oasis to Downtown: ~18-20 Minutes.

Are you telling me that saving 8 minutes of driving is worth paying an extra 37 Million AED?

When you look at the Dubai 2040 Vision, the city is expanding towards the DWC Airport and the Jebel Ali corridor. The Oasis is smack in the middle of this new growth zone. You aren't buying on the outskirts; you are buying in the future center.

The Rental Income Argument

Some clients tell me, "But Ali, if I buy in District One, I can rent it out now."

Fair point. Let’s run that scenario.

If you buy in District One for 24M (a smaller unit) and rent it out for 4 years, you might make 8M in rent.

But if you buy in The Oasis for 15M (a 5-bed example) and the capital appreciation hits 100% by handover (which is conservative given the gap), you have made 15 Million AED in profit without dealing with a single tenant or maintenance issue.

The "Growth Play" almost always beats the "Yield Play" in a developing luxury market.

The Verdict

History tells us that Emaar master communities always appreciate. We saw it with The Meadows, we saw it with Arabian Ranches, and we saw it with Dubai Hills.

The Oasis is the next chapter. But with only 3,100 villas (down from the original 7,000), the supply is tighter than ever. This isn't just a purchase; it's a legacy asset.