31 Above - Dubai Maritime City

Investment Starts From

Starting from AED 2.5M

Project General Facts

Property Type

Office

Developer

Beyond (Powered by Omniyat)

Completion Date

Sale Status

Investment Features

About This Project

Comprehensive project overview and investment highlights

ALI FAIZAN'S VERDICT (SCORE: 9.6/10)

This is not just an office; it is a structural arbitrage opportunity in the Dubai Real Estate Market.

In my 10 years of analyzing Dubai's market cycles, I have seen trends come and go. But the shift we are witnessing right now towards Commercial Waterfront Assets is not a trend it is a fundamental correction of supply and demand. For years, investors have poured capital into residential towers, leaving the commercial sector undersupplied, specifically regarding Grade-A stock with lifestyle amenities.

31 Above represents a pivotal moment. It is the first commercial tower in the Dubai Maritime City (DMC) master plan. It is developed by Beyond, the new division of Omniyat the developer that redefined Business Bay with The Opus and Palm Jumeirah with One Palm. You are buying Omniyat DNA at an entry price that the market has not yet fully appreciated.

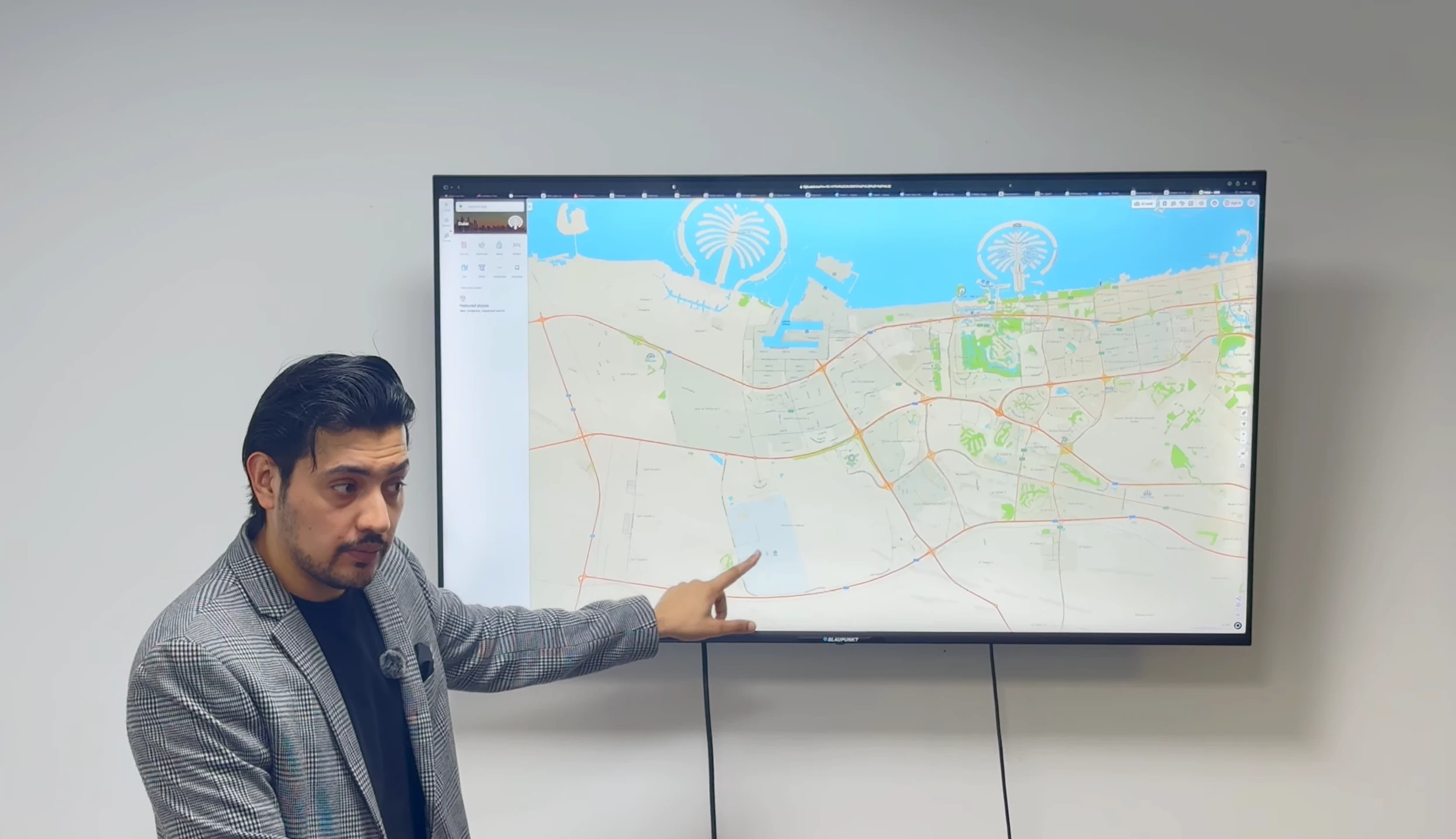

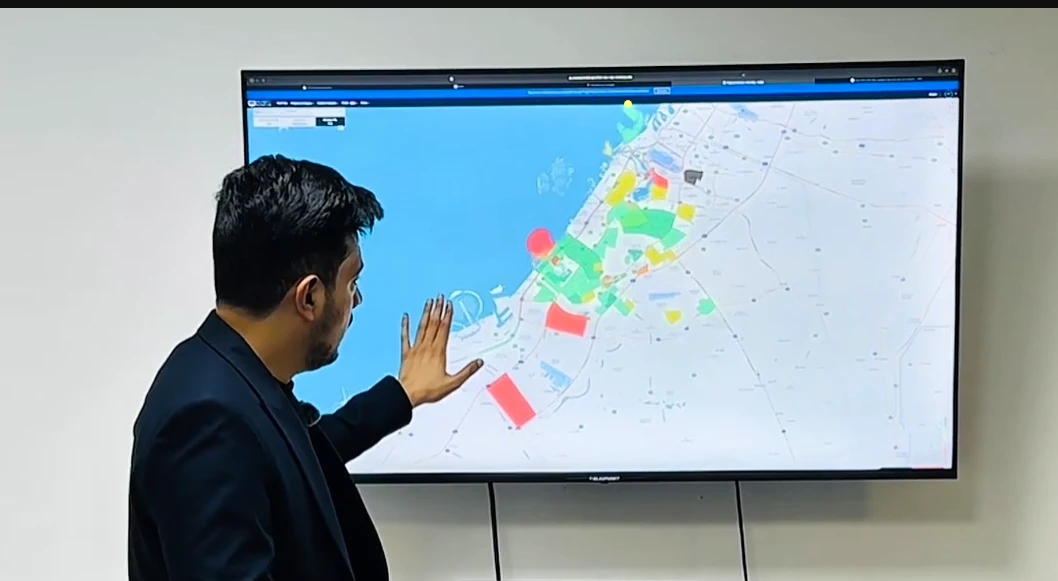

THE MACRO ANALYSIS: WHY DUBAI MARITIME CITY?

To understand the value of 31 Above, you must understand the history of the land it sits on. Dubai Maritime City is a 249-hectare man-made peninsula. For two decades, it was viewed purely as an industrial hub. But just as Barangaroo transformed Sydney's docklands and HafenCity transformed Hamburg, DMC is currently undergoing a massive regeneration into an ultra-luxury lifestyle and commercial destination.

The Dubai Government is currently deploying AED 5.3 Billion into the Al Shindagha Corridor. This is not a promise; it is active construction. This infrastructure upgrade will seamlessly connect this peninsula to the heart of Downtown Dubai in under 15 minutes. History teaches us one undeniable rule: Property values follow infrastructure. Investors who position themselves before the bridges open typically see the highest capital appreciation.

THE DEVELOPER: THE OMNIYAT PREMIUM

In real estate, the developer is your business partner. Omniyat is widely regarded as the 'Apple' of Dubai real estate. They do not build generic towers. Their commercial assets, such as The Opus by Zaha Hadid and One by Omniyat, command the highest rental rates and resale values in Business Bay. With Beyond, they are bringing this ultra-luxury philosophy to a wider market segment. They are creating a 'Resort for Work a concept that is desperately needed in a post-pandemic world where top talent demands more than just a desk.

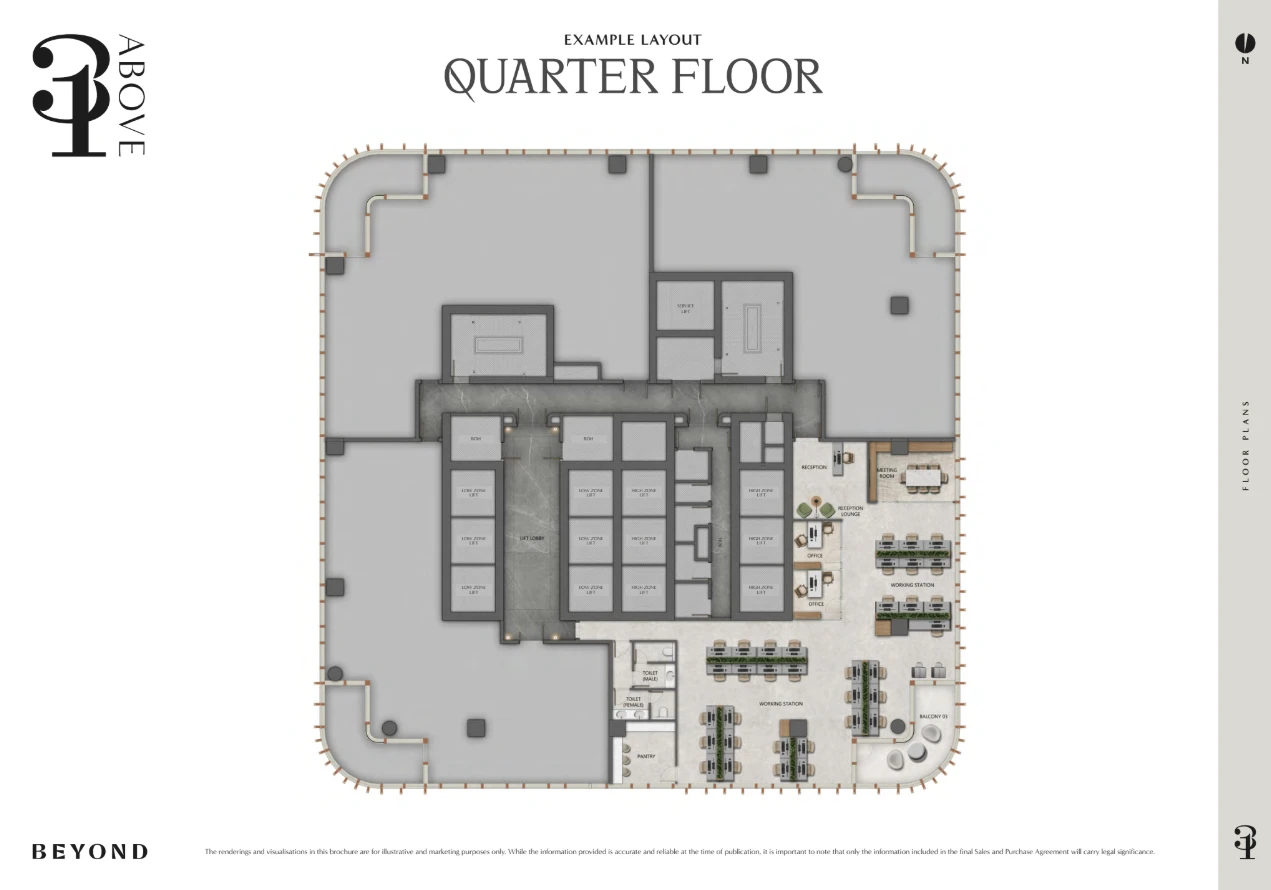

THE ARCHITECTURE: A SCULPTURE, NOT A BOX

Most office buildings are efficient but soulless glass boxes. 31 Above is different. The architecture features six stacked, shifted volumes. This 'mass shifting' is not just aesthetic; it is functional. It creates natural shading and, crucially, allows for landscaped terraces on every single floor. This is biophilic design at its finest.

Imagine hosting a client meeting on your private terrace, 31 floors up, with a 360-degree unobstructed view of the Arabian Gulf and the Dubai Skyline. This is the kind of 'Soft Power' that closes deals.

THE INTERIORS & SPECIFICATIONS

Omniyat knows that space is luxury. While standard Dubai offices offer 2.8m ceiling heights, 31 Above offers a generous 3.2-meter clear ceiling height. The floor-to-ceiling high-performance glazing maximizes natural light while minimizing heat gain.

- The Lobby: A triple-height entrance statement with stone walls, marble reception counters, and bespoke metal detailing. It feels like a 5-star hotel, not a corporate lobby.

- Vertical Transportation: Time is money. The tower is serviced by 16 high-speed elevators, split into Low Zone and High Zone banks, ensuring zero wait times during peak hours.

- Parking: A robust ratio of 1 bay per 50 sqm, totaling 678 bays across 5 podium levels.

INVESTMENT POTENTIAL: COMMERCIAL VS. RESIDENTIAL

Why invest in commercial? Let's look at the numbers. Residential yields in Dubai typically hover between 5-7%. Commercial assets, particularly Grade-A waterfront stock, often achieve 8-10% net yields.

Furthermore, commercial tenants (companies) are 'sticky.' They sign longer leases (3-5 years), they invest their own capital into the fit-out (increasing your asset value), and they rarely default compared to individual residential tenants. With less than 5% of Dubai's office stock offering direct waterfront views, 31 Above possesses immense scarcity value.

THE LIFESTYLE: THE 'FOREST ON THE SEA'

This project is part of a wider ecosystem. Just a 5-minute walk (or 2-minute drive) across the connecting bridge lies the 'Forest District' a biophilic wonder with over 2,000 trees planted on the sea. Residents and office workers at 31 Above will have access to a retail boulevard, fine dining restaurants, and even a surfing wave pool in the ocean. This is a work-life balance that currently does not exist anywhere else in Dubai.

MY FINAL RECOMMENDATION

If you are an investor looking for 'Safe Haven' assets, buy ready property in Downtown. But if you are a Growth Investor looking to double your equity over the next 5 years, you buy into regeneration zones like Dubai Maritime City. You buy the first commercial tower before the rest of the district wakes up to the value.

31 Above is a Buy.

Complete Property Specifications

Comprehensive property features and finishes

Flooring

Concrete (Ready for fit-out)

Window Type

High-Performance Thermal Glazing

Ali Faizan Sayed's Investment Analysis

RERA Certified Investment Consultant with 10 Years Experience

My Personal Recommendation

"With over 10 years of experience and 512M+ AED in closed deals, I've personally analyzed this project from both technical and investment perspectives. The combination of Beyond (Powered by Omniyat)'s proven track record, Dubai Maritime City (DMC), Dubai's strategic importance, and current market conditions makes this one of my top recommendations for UHNWI investors in 2025."

Why I Personally Recommend This

- I highly recommend 31 Above for investors looking to diversify their portfolio. Commercial real estate in Dubai is currently undersupplied, especially Grade-A waterfront stock. Buying the *first* office tower in a master plan by a developer like Omniyat is a textbook value-investing play.

- "Residential real estate buys you comfort. Commercial real estate buys you freedom. Here is the financial logic behind 31 Above." To understand the Return on Investment (ROI) potential of 31 Above, we must first acknowledge the current divergence in the Dubai property market. While the residential sector has seen massive growth, the Grade-A Commercial Sector is facing a critical undersupply. Occupancy rates in prime business districts (DIFC, Downtown, Business Bay) are hovering above 92%, driving rental rates to record highs. By investing in 31 Above, you are positioning yourself in a high-demand, low-supply asset class. Here is my professional projection based on current market data and the "Omniyat Premium." 1. PROJECTED RENTAL YIELDS: 8.5% – 10% (NET) Unlike residential units, where landlords often bear the cost of service charges and maintenance, commercial leases in Dubai are shifting towards Triple Net Leases (NNN). This means the tenant (the company) covers the fit-out, the utilities, and often the service charges. The Baseline: Standard commercial offices in Business Bay currently generate 6-7% net yields. The 31 Above Advantage: Because this is a Waterfront Grade-A Asset with "Resort Amenities" (Valet, Gym, Terraces), it will command a significant premium. The Comparables: Look at The Opus by Omniyat in Business Bay. It commands rents 30-40% higher than neighboring towers simply because of the brand and the quality. I project 31 Above will achieve similar dominance in the Maritime City district. Target Rent: Conservatively, we are looking at rental rates of AED 250 – AED 300 per sq. ft. upon handover in 2027. On an entry price of roughly AED 3,000 per sq. ft., this translates to a Gross Yield of ~10%, netting out to a solid 8.5% - 9% after minor deductions. 2. CAPITAL APPRECIATION: 35% – 45% (by 2028) This is where the "Regeneration Zone" factor comes into play. You are buying at today's "Construction Site" prices, but you will be selling (or re-valuing) at tomorrow's "Destination" prices. The Entry Point: Current launch prices for 31 Above are estimated around AED 2,800 – AED 3,200 per sq. ft. (depending on floor/view). The Value Gap: Comparable ready luxury commercial space in DIFC or prime Downtown trades upwards of AED 4,500 – AED 5,500 per sq. ft. The Catalyst: By Q4 2027, three things will happen simultaneously: The building completes. The Al Shindagha Corridor infrastructure fully matures. The surrounding residential community (The Bay, The Forest) comes to life. The Result: As the district establishes itself as the "New Jumeirah Extension," I project the price per square foot to correct upwards to AED 4,000+. This represents a 35% to 45% growth on the asset value. 3. RETURN ON EQUITY (ROE): The Leverage Play Smart investors look at ROE, not just ROI. Because of the 60/40 Payment Plan, your cash-on-cash return is amplified. Scenario: You buy a Quarter Floor for AED 3,000,000. Cash Invested (60%): AED 1,800,000 over the construction period. On Handover: You finance the remaining 40% (AED 1.2M) via a commercial mortgage. Outcome: If the property value increases by just 30% (to AED 3.9M) by handover, your profit is AED 900,000. ROE: That represents a 50% Return on your Cash Invested (AED 900k profit on AED 1.8M cash), before you even collect your first rental cheque. Ali Faizan's Conclusion: "31 Above offers a defensive moat against market volatility. High-quality commercial tenants sign 3-5 year leases, providing stable, predictable cash flow that outperforms residential assets. Combined with the capital growth of the Maritime City regeneration, this is a double-digit return opportunity."

- Ideal for seasoned investors seeking high-yield rental assets (8%+) and business owners looking to secure a future HQ at today's prices.

- High scarcity (commercial waterfront), Tier-1 Developer (Omniyat/Beyond), and massive government infrastructure backing.

Risk Mitigation Strategy

- High scarcity (commercial waterfront), Tier-1 Developer (Omniyat/Beyond), and massive government infrastructure backing.

- Risk Level: low

- I have stood on a lot of sand in this city. And I have learned that the sand you buy today determines the skyscraper you own tomorrow." In my 10 years in Dubai real estate, having transacted over AED 550 million and studied the market’s history back to the 1960s, I have developed a sixth sense for "The Shift." The Shift is that specific moment when a location transitions from being overlooked to being oversubscribed. I saw it happen in Business Bay in 2015. I saw it happen in Dubai Hills Estate in 2017. And today, I am seeing the exact same indicators in Dubai Maritime City (DMC). When I first drove out to the Jumeirah Peninsula site for 31 Above, I’ll be honest I had the same reservations many of my clients initially have. "It’s near the dry docks," I thought. "Is it going to be noisy? Is it going to feel industrial?" But the moment I crossed the causeway, my perspective shifted entirely. The "Quiet" Revelation first thing that struck me was the silence. There is a massive misconception in the market that because DMC is near a working port, it must be loud and gritty. Standing on the plot of 31 Above, looking out towards the open sea, I realized how disconnected the residential and commercial peninsula is from the industrial precinct. The zoning here is masterful. The dry docks are separated, strictly regulated (ISO 14001 certified), and quiet. What you are left with on the peninsula is pure, unadulterated ocean frontage. I stood there for twenty minutes, just watching the waves hit the breakwater, with the Queen Elizabeth 2 (QE2) floating majestically to my right and the Burj Khalifa piercing the skyline to my left. It felt like an island sanctuary, yet I was only a 12-minute drive from Sheikh Zayed Road. That duality seclusion and connectivity is the rarest commodity in Dubai real estate. The Omniyat Factor: Lessons from The Opus My confidence in this project isn't just about the land; it’s about the partner. I have a long history of selling Omniyat projects. I remember when they launched The Opus by Zaha Hadid in Business Bay. At the time, Business Bay was a construction site. Investors were skeptical. "Why pay a premium for this location?" they asked. Fast forward to today. Business Bay is the commercial heart of the city, and The Opus is its crown jewel. The investors I guided into The Opus didn't just buy an office; they bought a landmark. They are achieving some of the highest rental yields per square foot in the entire city because tenants pay for prestige. With Beyond (Omniyat’s new division), I see history repeating itself, but with a twist. Beyond is bringing that same "Opus-level" engineering and design philosophy to a wider market. When I reviewed the floor plans for 31 Above, I didn't see the cost-cutting measures you usually see in "market-entry" products. I saw 3.2-meter ceiling heights. I saw terraces on every single floor. I saw a triple-height lobby that looks like a Mandarin Oriental hotel. This is Omniyat saying, "We are not lowering our standards; we are just expanding our reach." As an advisor, this gives me immense confidence. I know that in 5 years, when this tower is handed over, the build quality will still be pristine. That is what protects your resale value. The Commercial Void: What My Clients Are Telling Me The decision to recommend 31 Above is also driven by the pain points I hear from my clients every single day. I work with business owners, CEOs, and family offices who are desperate for high-quality office space. The conversation usually goes like this: "Ali, I need a modern office. I don't want to be in a glass box in JLT with traffic. I can't afford the crazy premiums of DIFC Gate Village. And I want my team to be happy coming to work." Until now, I had nowhere to send them. The market is saturated with old, inefficient stock or overpriced luxury with no parking. 31 Above is the solution to this specific gap. It is the first "Resort for Work." I imagine the future tenant here: a tech firm, a creative agency, or a boutique consultancy. They don't want a cubicle farm. They want to hold their Monday morning briefing on a private terrace overlooking the ocean. They want to take a client for lunch at the waterfront promenade downstairs. They want to walk across the bridge to the "Forest District" to clear their head. Post-pandemic, the office isn't just a place to type emails; it’s a recruitment tool. Top talent will choose the company with the ocean view and the yoga deck over the company in the dark building near the highway. That is why I believe the rental demand for this tower will be astronomical. The Infrastructure Play: The AED 5.3 Billion Guarantee Finally, let’s talk about the boring part that makes the most money: Infrastructure. I teach my investors the "Three Rules of Real Estate," and Rule #2 is Infrastructure Development. The Dubai Government does not spend AED 5.3 Billion on the Al Shindagha Corridor without a massive strategic plan. I have driven the new Infinity Bridge. It is a masterpiece of engineering. It has completely uncorked the traffic flow between Deira, Bur Dubai, and the maritime coast. By the time 31 Above hands over in late 2027, this road network will be fully mature. The "perceived distance" of Maritime City will vanish. It will be psychologically and physically integrated into the Downtown core. My Verdict I often tell my clients: "You make your money when you buy, not when you sell." Buying in Downtown today is buying at the top of the curve. It’s safe, but the explosive growth is behind us. Buying in Dubai Maritime City today is buying at the start of the curve. You are buying the First Commercial Tower in a master plan that is 11 million square feet large. You are buying before the retail mall opens, before the Dorchester hotel opens, and before the mass market realizes that this is the new "Jumeirah Extension." I have helped 200+ investors build portfolios, and the ones who are wealthiest today are the ones who bought into the vision of a master plan while others were waiting for the "reality." 31 Above is not for the timid investor who needs to see a busy street today. It is for the visionary investor who understands that in 4 years, this will be the most coveted commercial address on the coast. If I were building a commercial portfolio today, this would be my anchor asset. The numbers make sense, the developer is world-class, and the lifestyle is unmatched. This is a buy.

Detailed Investment Insights

My professional analysis based on 10 Years experience and market research

Scarcity

First and only commercial tower launched in the new phase. Less than 5% of Dubai offices have direct sea views.

Infrastructure

AED 5.3 Billion government spend on Al Shindagha Corridor ensures long-term accessibility and value growth.

Developer

Omniyat is the 'Apple' of real estate. Their commercial assets (The Opus, One by Omniyat) command the highest rents in Business Bay.

Design

Terraces on every floor is a post-pandemic design necessity. This 'Resort Office' concept attracts premium tenants.

Who Should Invest in This Property?

Ideal for seasoned investors seeking high-yield rental assets (8%+) and business owners looking to secure a future HQ at today's prices.

My Personal Experience with Similar Projects

I have stood on a lot of sand in this city. And I have learned that the sand you buy today determines the skyscraper you own tomorrow." In my 10 years in Dubai real estate, having transacted over AED 550 million and studied the market’s history back to the 1960s, I have developed a sixth sense for "The Shift." The Shift is that specific moment when a location transitions from being overlooked to being oversubscribed. I saw it happen in Business Bay in 2015. I saw it happen in Dubai Hills Estate in 2017. And today, I am seeing the exact same indicators in Dubai Maritime City (DMC). When I first drove out to the Jumeirah Peninsula site for 31 Above, I’ll be honest I had the same reservations many of my clients initially have. "It’s near the dry docks," I thought. "Is it going to be noisy? Is it going to feel industrial?" But the moment I crossed the causeway, my perspective shifted entirely. The "Quiet" Revelation first thing that struck me was the silence. There is a massive misconception in the market that because DMC is near a working port, it must be loud and gritty. Standing on the plot of 31 Above, looking out towards the open sea, I realized how disconnected the residential and commercial peninsula is from the industrial precinct. The zoning here is masterful. The dry docks are separated, strictly regulated (ISO 14001 certified), and quiet. What you are left with on the peninsula is pure, unadulterated ocean frontage. I stood there for twenty minutes, just watching the waves hit the breakwater, with the Queen Elizabeth 2 (QE2) floating majestically to my right and the Burj Khalifa piercing the skyline to my left. It felt like an island sanctuary, yet I was only a 12-minute drive from Sheikh Zayed Road. That duality seclusion and connectivity is the rarest commodity in Dubai real estate. The Omniyat Factor: Lessons from The Opus My confidence in this project isn't just about the land; it’s about the partner. I have a long history of selling Omniyat projects. I remember when they launched The Opus by Zaha Hadid in Business Bay. At the time, Business Bay was a construction site. Investors were skeptical. "Why pay a premium for this location?" they asked. Fast forward to today. Business Bay is the commercial heart of the city, and The Opus is its crown jewel. The investors I guided into The Opus didn't just buy an office; they bought a landmark. They are achieving some of the highest rental yields per square foot in the entire city because tenants pay for prestige. With Beyond (Omniyat’s new division), I see history repeating itself, but with a twist. Beyond is bringing that same "Opus-level" engineering and design philosophy to a wider market. When I reviewed the floor plans for 31 Above, I didn't see the cost-cutting measures you usually see in "market-entry" products. I saw 3.2-meter ceiling heights. I saw terraces on every single floor. I saw a triple-height lobby that looks like a Mandarin Oriental hotel. This is Omniyat saying, "We are not lowering our standards; we are just expanding our reach." As an advisor, this gives me immense confidence. I know that in 5 years, when this tower is handed over, the build quality will still be pristine. That is what protects your resale value. The Commercial Void: What My Clients Are Telling Me The decision to recommend 31 Above is also driven by the pain points I hear from my clients every single day. I work with business owners, CEOs, and family offices who are desperate for high-quality office space. The conversation usually goes like this: "Ali, I need a modern office. I don't want to be in a glass box in JLT with traffic. I can't afford the crazy premiums of DIFC Gate Village. And I want my team to be happy coming to work." Until now, I had nowhere to send them. The market is saturated with old, inefficient stock or overpriced luxury with no parking. 31 Above is the solution to this specific gap. It is the first "Resort for Work." I imagine the future tenant here: a tech firm, a creative agency, or a boutique consultancy. They don't want a cubicle farm. They want to hold their Monday morning briefing on a private terrace overlooking the ocean. They want to take a client for lunch at the waterfront promenade downstairs. They want to walk across the bridge to the "Forest District" to clear their head. Post-pandemic, the office isn't just a place to type emails; it’s a recruitment tool. Top talent will choose the company with the ocean view and the yoga deck over the company in the dark building near the highway. That is why I believe the rental demand for this tower will be astronomical. The Infrastructure Play: The AED 5.3 Billion Guarantee Finally, let’s talk about the boring part that makes the most money: Infrastructure. I teach my investors the "Three Rules of Real Estate," and Rule #2 is Infrastructure Development. The Dubai Government does not spend AED 5.3 Billion on the Al Shindagha Corridor without a massive strategic plan. I have driven the new Infinity Bridge. It is a masterpiece of engineering. It has completely uncorked the traffic flow between Deira, Bur Dubai, and the maritime coast. By the time 31 Above hands over in late 2027, this road network will be fully mature. The "perceived distance" of Maritime City will vanish. It will be psychologically and physically integrated into the Downtown core. My Verdict I often tell my clients: "You make your money when you buy, not when you sell." Buying in Downtown today is buying at the top of the curve. It’s safe, but the explosive growth is behind us. Buying in Dubai Maritime City today is buying at the start of the curve. You are buying the First Commercial Tower in a master plan that is 11 million square feet large. You are buying before the retail mall opens, before the Dorchester hotel opens, and before the mass market realizes that this is the new "Jumeirah Extension." I have helped 200+ investors build portfolios, and the ones who are wealthiest today are the ones who bought into the vision of a master plan while others were waiting for the "reality." 31 Above is not for the timid investor who needs to see a busy street today. It is for the visionary investor who understands that in 4 years, this will be the most coveted commercial address on the coast. If I were building a commercial portfolio today, this would be my anchor asset. The numbers make sense, the developer is world-class, and the lifestyle is unmatched. This is a buy.

Ready to Discuss This Investment?

Let's schedule a personal consultation where I can share more detailed insights, show you comparable projects, and create a customized investment strategy.

Unit Types & Configurations

Explore floor plans, layouts, and investment potential

🏠Quarter Floor OfficeOffice

Unit Specifications

Investment Opportunity Dashboard

Professional ROI analysis and market intelligence

Investment Parameters

Investment Returns

Enhanced Payment Calculator

Smart payment planning with multiple financing options

Select Your Unit

Quarter Floor Office

0

AED 2,500,000

Half Floor Office

0

AED 5,500,000

Full Floor HQ

0

AED 13,000,000

Choose Payment Plan

Flexible Payment Plan

Extended timeline with manageable payments

Accelerated Payment Plan

Quick completion with attractive discounts

Investor-Friendly Plan

Optimized for maximum leverage

Payment Schedule - Flexible Payment Plan

Based on unit price: AED 2,500,000

Down Payment

Construction Payments

Final Payment

Ready to Secure Your Investment?

Get personalized payment options and secure the best available unit. Our finance specialists can help optimize your investment structure.

Media Gallery

Explore property images and video content

Comprehensive Location Analysis

Deep dive into Dubai Maritime City (DMC), Dubai's investment potential, infrastructure, and lifestyle advantages

Developer Reputation Analysis

Understanding Beyond (Powered by Omniyat)'s track record and how it impacts your investment

Risk Assessment

Market Intelligence by Ali Faizan

Expert market analysis and investment predictions

My Market Analysis & Predictions

"Based on my decade of experience analyzing Dubai Maritime City (DMC), Dubai's market dynamics, infrastructure pipeline, and demographic trends, I project this area will emerge as one of Dubai's premium investment destinations by 2027. The timing couldn't be better for strategic UHNWI investors."

Investment Timeline Predictions

My forecasts for different investment horizons

1–2 Years

Steady appreciation, strong rental demand driven by economic growth

3–5 Years

Significant growth due to infrastructure completion and area maturity

5–10 Years

Premium location status established, peak investment returns

Key Market Drivers I'm Watching

Infrastructure Development

Metro extensions, new highways, and smart city initiatives underway

Population Growth

Professional expat influx, growing high-income community

Government Initiatives

Golden visa, 100% foreign ownership, business-friendly policies

Economic Diversification

Post-pandemic recovery, tourism boom, business hub expansion

Risk Assessment & Mitigation

Market Oversupply

Prime location insulates from general market fluctuations

Interest Rate Changes

Fixed-rate financing options available

Construction Delays

Developer's strong track record minimizes risk

Economic Downturn

Dubai's diversified economy provides resilience

Get Detailed Market Report

Want deeper insights? I can provide a comprehensive market analysis report with detailed comparables, ROI projections, and strategic recommendations.

Dubai Market Intelligence & Trends

Expert analysis of market conditions, pricing trends, and optimal investment timing

Property Amenities

Interactive Map

Dubai Maritime City (DMC), Dubai

Open in Maps App

Coordinates: 25.269000, 55.303000

Nearby Attractions & Amenities

Explore what makes Dubai Maritime City (DMC), Dubai exceptional

away

Port Rashid

away

Dubai Dry Docks

away

Dubai Healthcare City

away

Al Jaddaf

away

Dubai Creek

away

Dubai International Airport

How to Invest in 31 Above - Dubai Maritime City

Step-by-step guide to investing in 31 Above - Dubai Maritime City by Beyond (Powered by Omniyat)

Required Documents:

Tools Needed:

Schedule Consultation

Book a free consultation with our Dubai real estate experts to discuss your investment goals and property requirements.

Property Tour & Analysis

Visit the property location and review detailed investment analysis including ROI projections, payment plans, and market comparison.

Documentation & Payment

Submit required documents (passport, visa, Emirates ID if applicable) and pay booking amount of AED 250,000.

SPA & Registration

Sign Sale and Purchase Agreement (SPA) with developer, complete registration with Dubai Land Department, and begin payment plan.

Similar Projects in Prime Locations

Explore comparable investment opportunities in Dubai's most sought-after neighborhoods

Investment Insights & Guides

Expert analysis and market insights to guide your investment decisions

The 142% Gap: Why The Oasis by Emaar is the Smartest Buy vs. District One

Everyone is talking about District One, but the smart money is looking at the numbers. I’ve analyzed the price-per-sq-ft, and The Oasis offers a 142% value gap. Here is why this is the "gift" the market has been waiting for.

The Price of Hesitation: Why Delaying Your Dubai Real Estate Investment Costs You 0.88% Every Month

In a market where developers sell out in two hours, hesitation is the biggest expense. Drawing on precise Q1 2025 data, I break down the cost of waiting an increase of 0.88% per month and why using logic and numbers is the only way to capitalize on Dubai's unprecedented growth.

Why Less Than 2% of Dubai Properties Have Direct Beach Access

Ali Faizan Syed explains the geographic scarcity driving Ultra Luxury prices: only 7% of Dubai is waterfront, and less than 2% has direct beach access. Learn how this rarity affects HNI investment strategy.

Frequently Asked Questions

Project-specific questions and answers

General

Still Have Questions?

Our real estate experts are available to provide personalized answers and detailed information about this investment opportunity.